Protecting floors and maintaining hygiene can be frustrating when shoe covers tear or slip easily. Choosing the right source is confusing for businesses and homes alike. Here, we highlight the top 9 disposable shoe cover manufacturers in the world, showing trusted brands that provide strong, affordable, and effective protection.

Morntrip (Disposable Shoe Cover Manufacturer in China)

Morntrip runs operations from Xiantao, Hubei, China’s largest PPE manufacturing hub. The company has made disposable shoe covers for over 20 years. Their 50,000 m² facility has a 5,000 m² clean factory built in 2018 for medical-grade products. This setup efficiently handles high-volume orders and meets cleanroom requirements.

They ship 30+ containers monthly to 120+ countries. This proves their export strength. Major clients include UK-based ARCO and Italy’s Cofra. Hospitals and government agencies across Europe and North America also buy from them. Production lines make 30,000 disposable coveralls daily. They run 80+ automatic mask machines. So they can ramp up fast during demand spikes.

Every order goes through triple-stage quality checks. Their in-house lab tests for CE, ISO 13485, FDA, EN 14126 (biohazard protection), EN 1149 (antistatic), and EN 1073 (radioactive particle resistance). Few Chinese disposable shoe cover manufacturers have this many certifications. They cover medical, industrial, and nuclear uses.

Custom orders start at 5,000 units MOQ. You can choose water-repellent and antibacterial fabrics. Free samples let you test fit before bulk buys. Plus, 24/7 support is available. Factory-direct prices cut out middleman costs. Contamination controls stay strict.

Farstar Medical (Disposable Shoe Cover Manufacturer in China)

Farstar Medical runs specialized divisions in China and Germany. The Wuxi Farstar Medical Equipment branch in China makes niche medical devices. They focus on eye phototherapy masks for newborn care. The German office—Farstar Medical GmbH—builds respiratory and anesthesia gas blenders. These go into hospital operating rooms.

Global market reports track Farstar in the medical gas blender sector. This market was worth USD 1,927.07 million in 2024. Experts predict it will hit USD 2,788.42 million by 2033. Farstar ranks among the key players. Others include Medin Medical Innovations, Heyer Medical, and Armstrong Medical.

Market research shows Farstar’s SWOT analysis and new products. But public records reveal something important. There’s no proof that Farstar makes disposable shoe covers . Their product lines focus on breathing equipment and light therapy devices. Not protective footwear or nonwoven PPE.

Looking for disposable shoe covers manufacturers? Check product catalogs yourself first. This avoids mix-ups with Farstar’s real focus. They specialize in medical gas delivery systems and newborn treatment devices.

Medline (Disposable Shoe Cover Manufacturer in the United States)

Medline is North America’s largest medical supply manufacturer and distributor under private ownership. Based in Northfield, Illinois, the company runs 20+ manufacturing plants and 60+ distribution centers. These facilities span 100+ countries. Blackstone, Carlyle, and Hellman & Friedman own the majority stake. The network serves hospitals, health systems, and physician offices around the globe.

The numbers show scale. 2024 net sales hit $25.5 billion. Net income reached $1.2 billion. The first nine months of 2025 brought in $20.6 billion—up from the year before. Over twelve months, revenue totaled $26.70 billion with +9.80% growth. The company has 43,000 employees. Each one brings in $620,977 in revenue.

Medline stocks 335,000 SKUs covering all medical-surgical needs. The Medline Brand segment offers high-margin products. This segment makes up just under 50% of sales but brings in over 80% of segment EBITDA. Products include PPE items: disposable shoe covers, disposable gowns , and masks . Hospitals use these for infection control.

December 2025 brings Medline’s Nasdaq IPO. The ticker is MDLN. The company aims to raise $5.37 billion. Shares price at $26–$30 each across 179 million shares. This puts the company value at $48–$55.3 billion. That makes it the largest U.S. IPO of 2025. Major investors put down $2.35 billion before the IPO. The money goes to paying down debt and funding growth.

Ansell (Disposable Shoe Cover Manufacturer in Australia)

Ansell Limited runs operations from Melbourne. They employ 15,000 people across their global facilities. The ASX-listed company (ANN) brought in $2.00 billion USD in annual sales for the fiscal year 2025 ending June 30. That’s 23.7% reported growth year-over-year. Growth in organic constant currency hit 7.7%. Strong momentum in protective equipment markets.

The Healthcare segment drives 55% of total sales at $1.10 billion. This division makes exam gloves and single-use products. Think disposable shoe covers for medical settings . Sales grew 9.4% organic constant currency in FY25. The first half alone saw 16.3% organic growth. Hospitals restocked infection control supplies.

Ansell’s KBU acquisition brought $274.2 million in sales. Kimtech cleanroom products under this brand posted double-digit growth. Pharmaceutical plants use these items. So do semiconductor facilities that need contamination barriers. The company put $68.0 million in net capex to work. This includes a new surgical facility in India. More capacity for medical-grade protective wear.

EBIT margin reached 14.1% with $282.1 million in earnings. Operating cash flow hit $105.4 million at 91% cash conversion. Net debt sits at 1.6x EBITDA. That’s comfortable leverage for a manufacturer scaling production. Revenue per employee stands at $133,550. Operations run efficiently across manufacturing sites.

UVEX (Disposable Shoe Cover Manufacturer in Germany)

The UVEX Group brought in EUR 666 million in revenue for the fiscal year 2023/24. That’s +1.7% growth over the prior year. The safety division powered results with EUR 546 million in sales—up 4.6% year-over-year. This unit produces personal protective gear. Think disposable shoe covers for factories and hospitals . Sports and leisure products dropped to EUR 126 million as demand cooled.

The company operates 49 branch offices across 23 countries. They run their own factories around the globe. International markets generate 58% of total sales. Warburg Pincus bought UVEX in 2025 at an EUR 800 million valuation. Investors clearly trust the protective gear market.

EBITDA reached EUR 85.9 million with a 13% margin in FY 2023/24. The uvex safety line plus HexArmor (their U.S. arm) makes up 82% of 2024 revenue. Work safety gloves drove growth. U.S. gains through HexArmor hit double digits. Online sales direct to buyers jumped +19% in FY 2022/23. Most safety products performed well. Respiratory gear and workwear lagged behind.

Toyo Lintfree (Disposable Shoe Cover Manufacturer in Japan)

Toyo Lintfree Co., Ltd. leads Japan’s cleanroom supplies market. They focus on contamination control. Semiconductor factories, pharmaceutical clean rooms, and precision electronics plants use their low-particle, low-lint products. The company serves ISO Class 3–6 environments. Some production lines operate in ISO 2 zones for critical wafer processing steps.

Their disposable cleanroom shoe covers are the benchmark in Japanese high-tech manufacturing. You get materials like PP nonwoven, PE film-laminated nonwoven for liquid barriers, and ESD-treated fabrics with carbon yarns. Universal sizing fits EU 36–46. Smaller batches come in S/M/L sizes. This gives tighter fit control for strict protocols.

Particle generation stays under 1.0–2.0 × 10³ particles per ft² at ≥0.3 µm after pre-cleaning. This beats standard non-cleanroom covers by a huge margin. ESD variants reach 10⁸–10¹¹ Ω/sq surface resistivity per JIS L 1094 standards. Charge decay drops from 5 kV to 0.5 kV in under 1.0 second. Electronics production lines need this fast decay. It prevents component damage.

Pharmaceutical customers can choose gamma-sterilized options at 25–40 kGy doses. Triple-bag packaging gives you 10⁻⁶ SAL (Sterility Assurance Level). These products work in ISO 5 Grade A/B background zones. They’re used during aseptic filling and compounding operations.

Kwalitex Healthcare (Disposable Shoe Cover Manufacturer in India)

Kwalitex Healthcare Private Limited runs from Thane, Maharashtra. They started in May 2015. The company has ROC Mumbai registration under CIN U18204MH2015PTC265017. Their factory makes disposable safety and surgical products. Hospitals and industrial sites across India use them. Active status and steady growth prove they’re stable. The PPE market is tough, but they keep going.

FY 2023 brought mixed results. Operating revenue sits between ₹1–100 crore. Total growth hit +9.47%. Net sales climbed +6.44% from the year before. Operating profit (EBIT) jumped by +12.74%. That’s faster than revenue gains. Cost efficiency got better. But EBITDA decreased at the same time. Pricing pressure or rising input costs probably cut into margins.

The company uses ₹19 million paid-up capital for daily work. Authorized share capital reaches ₹20 million. Revenue estimates stay under $5 million USD each year. This makes Kwalitex a mid-sized regional player. They serve local markets well. Global disposable shoe cover manufacturers are much bigger. Kwalitex can’t match their export reach or production size. They lack many international certifications. This blocks them from strict markets. EU medical supplies won’t accept them. U.S. hospital systems have tight rules, too.

ZP Mediheal (Disposable Shoe Cover Manufacturer in Brazil)

ZP Mediheal works as a distributor in Brazil. They don’t make disposable shoe covers themselves. Public records show little proof of actual production. Brazil’s PPE market depends on imports from Asia. Local makers focus on big hospitals.

Brazil’s medical supply scene is broken up. Most companies just distribute and repackage imported goods. Real manufacturing needs ANVISA certification. That’s Brazil’s health regulatory agency. You need strict facility checks. Compliance reviews happen regularly.

South American sourcing brings several hurdles. Currency values change often. Shipping costs run high. Quality varies a lot. Chinese and European disposable shoe cover manufacturers control Brazil’s hospital market. They give you better prices. Their certifications check out.

Check the ANVISA registration number before you commit to a Brazilian supplier. Ask for recent inspection reports. Find out if they make products or just distribute imports. This matters for quality control. It affects liability, too.

Supertouch (Disposable Shoe Cover Manufacturer in the United Kingdom)

Supertouch Industrial Supplies Limited carries Company Number 03730336 on the UK registry. The firm started on 10 March 1999. It stays Active from its Smethwick, England base at Unit 3, Rabone Park, B66 2NN. The brand began in 1996 as a protective workwear specialist. Today, it’s one of the UK’s most trusted names in disposable PPE and protective clothing .

The company has 51–200 staff across the UK and European areas. Business Development Managers reach markets “from Aberdeen to Zurich”. This wide reach helps hospitals, food plants, and clinical sites. You’ll find hi-visibility garments that meet EN471, EN343, and GO/RT 3279 railway standards. Disposable hygiene lines go to medical, clinical, and food production sites. Color-coded disposable shoe covers stop cross-contamination in controlled zones.

Supertouch tests all items in-house, on-site, and at independent approved labs. This three-step check ensures British and EN standards compliance. The disposables range has Kevlar® anti-cut gloves and leather rigger gloves plus protective footwear. Each product meets strict hygiene rules. Disposable shoe cover manufacturers in the UK medical field know Supertouch for quality and strict standards.

Comparison of Global Disposable Shoe Cover Manufacturers

Asia Pacific leads global production. China, India, Japan, and South Korea control the manufacturing scale. This region holds the largest market share. Growth looks fastest through 2034. Chinese disposable shoe cover manufacturers like Morntrip ship 30+ containers each month at factory-direct prices. Indian disposable shoe cover manufacturers such as Kwalitex serve local markets. They pull in ₹1–100 crore revenue but miss export certifications. Japan’s Toyo Lintfree owns the cleanroom space. Their ISO Class 2–6 particle control beats standard industrial covers by a wide margin.

North America drives premium demand. Healthcare and food processing sectors fuel this. Medline’s $26.70 billion revenue and 335,000 SKUs show a huge distribution reach across hospitals. Strict FDA and safety regulations force quality up. U.S. buyers pick established brands. Unknown imports don’t get the same trust.

European disposable shoe cover manufacturers like uvex (Germany) and Supertouch (UK) nail compliance. UVEX’s EUR 546 million safety division shows deep industrial PPE know-how. British and EN standard testing gives Supertouch solid credibility in medical markets. Australia’s Ansell brings both sides together. They hit $2 billion in revenue, with 55% from healthcare. Their 14.1% EBIT margins come from smart global operations.

Pricing gaps run wide. Asian disposable shoe cover manufacturers cut prices 40–60% below Western suppliers. Quality certifications split the field into tiers. ISO 13485, CE, and FDA compliance mark the serious medical-grade producers. Regional players often just move imports around. They don’t actually make anything.

How to Choose the Right Disposable Shoe Cover Manufacturer?

Your facility’s contamination control depends on the manufacturer you pick. They need to understand your specific environment. Map your application needs to material specs first. Then check the supplier’s technical skills and quality systems.

Match Material Capabilities to Your Environment

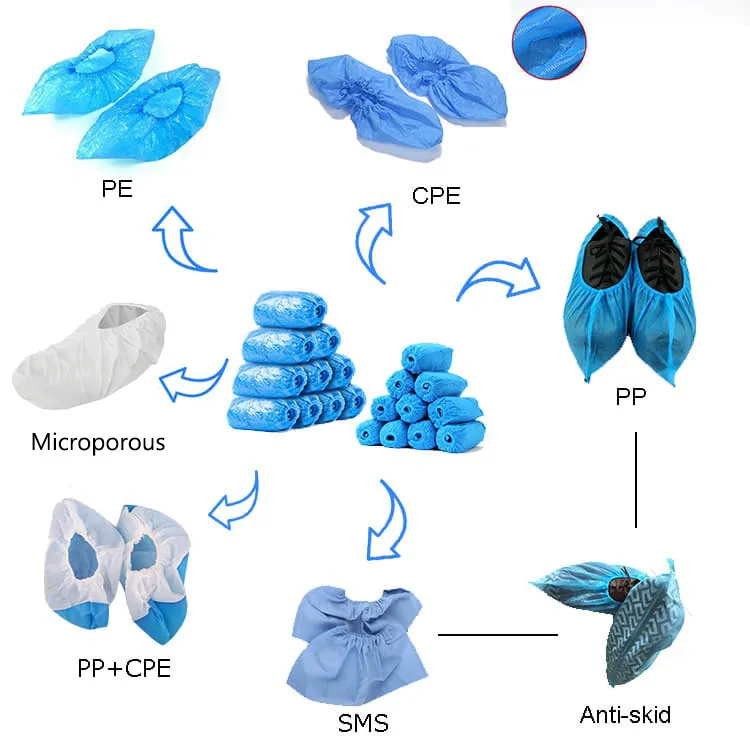

Ask disposable shoe cover manufacturers for GSM (grams per square meter) thickness data on all materials. Polypropylene (PP) spunbonded non-woven runs from 30–60 gsm. This lightweight, breathable material works well in dry healthcare settings and basic cleanrooms. But PP tears on rough surfaces. It sheds particles when people move. Skip PP for critical clean air zones. Contamination there ruins whole production batches.

Polyethylene (PE) gives you waterproof protection with smooth surfaces. Food processing plants need this for spills and wet floors. The material blocks liquids. You get an easy slip-on application. Chlorinated Polyethylene (CPE) tops the list for durability. Thickness runs 0.5–2 mm with seamless, heat-sealed construction. CPE works in wet, slippery, and chemical-exposed areas. Medical and industrial sites use it. Zero linting and no particle shedding. CPE is your best choice for precision manufacturing.

Check if disposable shoe cover manufacturers stock microporous film options like KleenGuard A40. These reach 5.25 inches in height with PVC soles. They pass ASTM F1670 for blood penetration resistance. They also meet NFPA 99 antistatic standards.

Verify Certification Documentation and Audit Access

Get proof of ASTM F1670 testing for bloodborne pathogen barriers. Ask for NFPA 99 antistatic compliance certificates. Confirm ANSI/ISEA 101-1996 sizing standards. Manufacturers serving cleanrooms must show ISO-compliant particle testing results. Look for specific data on non-litigating claims. Check breathable performance numbers too.

Request factory audit access before you sign contracts. Walk production lines yourself. Or hire third-party inspectors. CPE manufacturing needs heat-sealing equipment. Quality checks happen at every station. Factories making 60 gsm PE products like Valutek should show consistent thickness across production runs.

Assess Production Flexibility and Supply Chain Stability

Bulk packaging comes in 400 units per case for standard sizes. Disposable shoe cover manufacturers should offer private-label programs for industry-specific branding. Healthcare clients need different packaging than food service. Construction clients have different labeling rules, too.

Compare GSM and mm thickness guarantees across suppliers. Products above 40 gsm PP or 1 mm CPE last longer in rough or wet conditions. Coated PP falls apart under extended wear. Avoid suppliers who push this as a premium option. Quality rankings put CPE first for slip resistance and waterproofing. Higher upfront costs pay back fast. You replace fewer covers in high-traffic areas.

Pick manufacturers with ISO oversight for a stable, long-term supply. Ask about capacity during demand spikes. Check if they have backup production facilities.

FAQs About Disposable Shoe Cover Manufacturers

What is the current market size for disposable shoe covers?

The global disposable shoe cover market reached USD 1.40 billion in 2025. Analysts project it will hit USD 2.01 billion by 2032 at a 5.3% CAGR. The broader shoe cover market sits at USD 9.309 billion in 2024. Reusable options are part of this figure. Total market value should climb to USD 16.708 billion by 2032 with 7.6% annual growth.

Medical-grade disposable shoe covers have their own segment. This market stands at USD 2.5 billion in 2025 with 7% CAGR growth. Non-woven types alone were worth USD 1.2 billion in 2024. They’ll reach USD 2.5 billion by 2033 at a 9.2% CAGR. Single-use shoe covers went from USD 1.2 billion in 2023 to a projected USD 2.7 billion by 2032.

Which material type dominates production?

PE plastic shoe covers hold 41.9% market share in 2025. This material wins on cost. Oil-based plastics keep production cheap. Disposable shoe cover manufacturers can ramp up production fast. Poly-coated covers grow fastest at 9.8% CAGR. They give you non-slip surfaces plus waterproof barriers. Non-woven materials follow with a 9.2% CAGR through 2033. Buyers focused on cleanliness pick these for better particle control.

Which region leads the market?

North America captured 35.0% of global sales in 2025. The U.S. pushes this forward with strict HAI prevention rules. Top disposable shoe cover manufacturers run their operations there. Asia Pacific posts the fastest regional growth rate. China’s growing factories and building projects push demand higher. Money from other countries lifts production quality. Reusable covers and low awareness in developing areas hold back growth, though.

What end-use sector demands the most volume?

Hospitals account for 43.8% of total demand in 2025. Infection control rules need single-use footwear. Lots of patients mean facilities can’t wash reusable covers quickly enough. Disposables stop germs from spreading between rooms. Drug plants, food processing sites, and electronics makers also buy large amounts. These sectors stick to strict cleanliness rules that call for one-time-use products.

Conclusion

Global disposable shoe cover manufacturers vary in scale, quality, and certifications, from high-volume Chinese producers to specialized Japanese cleanroom suppliers and trusted Western brands. Material choice, compliance, and supply reliability are key for healthcare, industrial, and food sectors. For tailored disposable shoe covers that meet your specific needs, contact us today for a personalized quote.