Ever wonder how companies track the value of their assets over time? You’re not alone. Many business owners and students want to understand changes like a $100 decrease in PPE, but don’t know where to start. This post will walk you through it in a simple and friendly way.

Accounting for a $100 Decrease in PPE

When I see a $100 drop in Property, Plant, and Personal Protective Equipment on a balance sheet, I always want to know why. The reason is important because each cause has a different effect on the books. From my experience, the three main reasons for a drop in PPE are selling an asset, a sudden loss in value (impairment), or regular depreciation.

Asset Disposal: Selling or Retiring PPE

Your PPE value can go down if you sell, scrap, or retire a fixed asset. In this situation:

– The $100 decrease is the asset’s net book value. This is its original cost minus the depreciation taken so far. We remove this amount from the balance sheet.

– If you sell the asset for more or less than its book value, you record a gain or a loss on the income statement.

– Example: I’d say if you sell a machine with a $100 book value for $120, you record a $20 gain.

Impairment: Sudden Drop in Asset Value

I think of impairment as a sudden drop in an asset’s worth. This can happen unexpectedly. For instance, an asset gets damaged, a new technology makes it outdated, or the market for it crashes. This causes a permanent loss of value. Key points I always check:

– The company must lower the asset’s value on the books to its new, lower fair value.

– The $100 reduction is an impairment loss. I recommend showing this as a special expense in the financial statements.

– You can’t predict impairments. They are not a normal part of business operations.

Depreciation: Planned Reduction Over Time

Depreciation is simply accounting for an asset’s wear and tear over time. As you use an asset, its value goes down. With each accounting period:

– The company lowers the recorded value of its PPE by booking a depreciation expense.

– A $100 decrease could be the yearly or periodic depreciation for one or more assets.

– I want to be clear: this is not about the asset’s market price changing. It’s an accounting method to spread the asset’s cost over the years it will be used.

Understanding Book Value vs. Market Value

Based on my experience, it’s vital to know the difference between book value and market value. Book value changes come from accounting entries, like depreciation or impairment. Market value changes happen based on what someone would pay for the asset today.

– You record decreases in book value on the balance sheet.

– Changes in market value usually don’t show up in financial statements. The only exceptions are when an impairment happens or you sell the asset.

Quick Comparison Table

| Cause | Typical Trigger | Accounting Effect | Example Amount |

|---|---|---|---|

| Disposal | Sale/retirement | Remove net book value, gain/loss | Sell at NBV $100 |

| Impairment | Extraordinary loss | Write down to new fair value | Impair by $100 |

| Depreciation | Passage of time/use | Planned expense over asset life | Depreciate $100/year |

- I see depreciation as a regular and planned expense.

- Impairment is something I find to be sudden and unusual.

- When you dispose of an asset, you remove it from the books and may have a gain or loss.

Accounts Affected by a $100 Drop in PPE

From my experience, a $100 decrease in Property, Plant, and Personal Protective Equipment (PPE) can touch several accounts. It depends on the specific event causing the decrease. You’ll see changes on both the balance sheet and the income statement. I recommend checking these common accounts first:

- Property, Plant, and Personal Protective Equipment: This account will decrease. The amount of the decrease is either the asset’s original cost or the impairment value.

- Accumulated Depreciation: When you sell or retire an asset that has been depreciated, I find you also have to update this account. You must remove the depreciation that has built up over time.

- Loss on Disposal of Asset / Impairment Loss: You record a loss here as an expense. This happens if you sell the asset for less than its net book value. It also applies if you formally recognize an impairment.

- Cash or Receivables: I’ve seen these accounts increase when there’s a sale. The company either gets cash or has the right to receive it soon.

- Gain on Sale of Asset: If the cash you get is more than the asset’s net book value, you should record a gain.

Journal Entries for a $100 Decrease in PPE

Disposal Case: Selling or Retiring an Asset

Let’s assume an asset costs $1,000. It has accumulated depreciation of $850, making its net book value $150. You sell it for $50. This creates a $100 decrease in net PPE.

- First, I’d remove the asset from the books:

- Credit PPE for $1,000. This takes the asset’s cost off your balance sheet.

- Debit Accumulated Depreciation for $850. This removes the depreciation you’ve already recorded.

- Next, record the cash you received:

- Debit Cash for $50 from the sale.

- Then, record the loss on the sale:

- Debit Loss on Disposal for $100. This is the difference between the $150 net book value and the $50 you received.

Journal Entry Example:

Debit: Accumulated Depreciation $850

Debit: Cash $50

Debit: Loss on Disposal $100

Credit: PPE $1,000

I like this structure. It correctly removes the asset and its depreciation. It also adds the cash from the sale and shows the $100 loss on your income statement.

Impairment Case: Writing Down an Asset’s Value

Let’s imagine an asset has a current carrying amount of $1,135. The company determines it must recognize a $100 impairment.

- To record this impairment, I suggest:

- Debit Impairment Loss for $100. This is an expense.

- Credit PPE for $100. This reduces the asset’s value. You could also credit an “accumulated impairment” account if you track it that way.

Journal Entry Example:

Debit: Impairment Loss $100

Credit: PPE $100

This entry lowers the asset’s book value to its new, fair value. It also correctly recognizes the impairment loss as an expense on the income statement.

Practical Examples and Figures

- What if an impairment affects multiple PPE assets at once? My advice is to allocate the $100 decrease across them. You can do this based on each asset’s carrying value.

- For a larger example, imagine a $600,000 total impairment. You would need to assign it to each asset based on its relative value. This is called a pro-rata allocation. For instance, Pumps might get a $44,400 share, and Reactors a $111,000 share.

Key Takeaways on the Accounting Impact

- Based on my experience, disposals require you to adjust two things: the asset’s gross value and its accumulated depreciation. After that, you can book the gain or loss.

- Impairments are more straightforward. They reduce the asset’s carrying value, and you record a loss.

- I suggest you always remember the basics of debits and credits. You use debits to reduce accounts with credit balances, like accumulated depreciation. You also use them to record losses and expenses. You use credits to lower asset accounts or to show money coming in from a sale.

Balance Sheet Impact of a $100 Decrease in PPE

From my experience, I can explain what happens on the balance sheet when Property, Plant, and Personal Protective Equipment falls by $100. This drop can come from an impairment or derecognition. Here is how the balance sheet shows these changes:

- Gross PPE goes down by $100. For instance, an initial balance of $2,500 will become $2,400.

- For Accumulated Depreciation, the situation depends on the cause. In my view, with a simple impairment, accumulated depreciation does not change. But if you derecognize an asset, you also remove its accumulated depreciation. For an impairment where the asset stays, the net book value is what drops. The accumulated depreciation account is not touched.

- Your Net PPE (Carrying Amount) also drops by $100. I suggest remembering this formula: Net PPE equals Gross PPE minus Accumulated Depreciation. The new net PPE amount will show this lower value.

- As a result, your Total Assets will shrink by $100. This is because net PPE is a part of total assets. I recommend you watch this change, as it can impact key financial ratios.

Example Table: Before and After $100 Decrease in PPE

| Item | Before | Change | After |

|---|---|---|---|

| Gross PPE | $2,500 | -$100 | $2,400 |

| Accumulated Depreciation | $1,000 | $0 | $1,000 |

| Net PPE | $1,500 | -$100 | $1,400 |

| Total Assets | $5,000 | -$100 | $4,900 |

Key Points:

- You will not see an impairment loss as a separate line. I find that it directly reduces the net PPE value. The updated net PPE number already includes the loss.

- Accumulated depreciation stays the same. The only exception is if you completely write off an asset and all its related depreciation.

- I have seen that Net PPE cannot be negative. If an impairment brings an asset’s value to zero, you stop recording more losses for it.

- The effect on total assets happens right away. I think this makes the decrease very important when you analyze a company’s financial health.

Summary:

To summarize my points: a $100 drop in PPE lowers both the net book value of PPE and the total assets by $100. This is true for impairment and derecognition. I recommend you note that accumulated depreciation does not change unless the entire asset is removed. I believe this adjustment is essential for clear financial statements and good analysis.

Income Statement Impact of a $100 Decrease in PPE

If your company’s Property, Plant, and Personal Protective Equipment decreases by $100, the effect on the income statement changes. From my experience, the impact depends on the cause. The reason could be depreciation, a sale, an impairment, or a simple disposal.

How a $100 Decrease Affects Profit and Loss

Depreciation:

- You record the $100 decrease as a depreciation expense.

- This amount is part of your operating expenses. I often see it under Cost of Goods Sold (COGS) or Selling, General & Administrative (SG&A) expenses. The placement depends on how the asset was used.

- Depreciation lowers the company’s operating profit.

Sale or Disposal of PPE:

- I suggest you compare the asset’s net book value with the money you received from the sale. Net book value is just the original cost minus all the depreciation taken so far.

- If the sale proceeds are more than the net book value, you record a gain.

- If the sale proceeds are less, you record a loss.

- For example, scrapping an asset with a $100 net book value for zero proceeds creates a $100 loss. You show this loss as “Loss on Disposal of PPE” in operating expenses.

Impairment:

- If the asset’s recoverable amount is less than its value on your books, that $100 is an impairment loss.

- I recommend you record this on a separate expense line. You can label it Impairment Loss within your operating expenses.

Tax Shield and Net Income Reduction

- Expenses like depreciation or losses reduce your taxable income.

- With a tax rate of 20%, a $100 loss or expense reduces your tax expense by $20.

- The true impact on net income is cut to $80 after considering the tax effect ($100 decrease minus a $20 tax reduction).

- I find depreciation’s tax shield to be quite valuable because it reduces the cash you spend on taxes.

Example: $100 Decrease from Depreciation

- Income statement: A $100 depreciation expense reduces your pre-tax income.

- Tax effect: With a 20% tax rate, tax expense will drop by $20.

- Net income: After applying the tax shield, your net income falls by just $80.

- If a loss is not tax-deductible, your pre-tax income takes the full $100 reduction.

Deferred Tax from a $100 PPE Drop: Accounting vs. Tax

Let’s say your Property, Plant, and Personal Protective Equipment decreases by $100. From my experience, the way you account for this on your books rarely matches how you report it for taxes. This mismatch is what I call a timing difference. This is the core reason you create either a deferred tax asset (DTA) or a deferred tax liability (DTL).

Accounting Depreciation vs. Tax Depreciation

- Accounting Depreciation: This follows the standard rules of GAAP or IFRS. I see companies often use a straight-line method over the asset’s life. So, a $100 reduction in PPE from depreciation goes straight to your income statement as a $100 expense that year.

- Tax Depreciation: This uses different methods, like an accelerated or declining balance. I often point to the US IRS’s Capital Cost Allowance or Section 179 as examples. In my practice, I see tax laws let companies deduct costs much faster:

- Example: Section 179 lets you expense the full cost in the first year (up to $1,220,000 in 2024). This is far more than accounting standards permit.

- Buildings (Class 1) use a 4% CCA rate. Machinery (Class 8) has a 20% rate. Vehicles (Class 10) use a 30% rate.

Timing Differences and Deferred Tax

- Deferred Tax Liability: I see this happen when your tax depreciation for the year is more than your accounting depreciation. This lowers your taxable income today and saves you cash now. But I always caution that you will owe more taxes in the future when the deductions are smaller.

- Deferred Tax Asset: You create this when accounting depreciation is higher than tax depreciation. This results in higher taxable income now. The benefit I see is that you will pay less in taxes later as things even out.

- Calculation: I use a simple formula: Deferred tax = Timing difference × Tax rate

Example

- Year 1 accounting depreciation: $100

- Tax depreciation Year 1: $150 (using an accelerated method like CCA or Section 179)

- Temporary difference: $50 more is deducted for tax than for accounting

- Tax rate: 25%

- Deferred tax liability created: $50 × 25% = $12.50

Sale or Disposal Scenarios

- In my opinion, selling a building can also cause more timing differences. The tax system uses the “undepreciated capital cost,” not the book value, which I find leads to different tax effects.

- A large immediate deduction through Section 179 can reduce the tax book value to zero in the first year. Meanwhile, the accounting net book value decreases at a much slower pace.

Summary Table: My View on Rates and Effects

| Asset Type | CCA Rate | Section 179 Cap (2024) | My Take on the Tax Effect |

|---|---|---|---|

| Building | 4% | N/A | I see a slower deduction here. |

| Machinery | 20% | Up to $1,220,000 | I recommend this for a quick deduction. |

| Vehicle | 30% | – | This provides a fast deduction. |

My Key Points

- I always remind my clients that timing differences reverse. The asset’s book and tax values will eventually align, and the deferred tax balances will unwind.

- Your tax rate has a major impact. It determines the size of your deferred tax assets and liabilities.

- Your tax and accounting profits will differ in the short term. I suggest you focus on the long view, as they reconcile over the asset’s life.

I believe knowing these differences is very important for good tax planning. It also helps you see your true after-tax profit more clearly.

Financial Ratios Impact of a $100 Decrease in PPE

From my experience, when a PPE company‘s Property, Plant, and Personal Protective Equipment drops by $100, it changes key financial ratios right away. I find that these shifts can change how people view the company’s performance and risk.

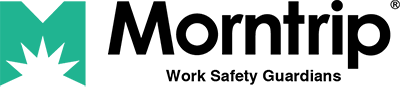

Asset Turnover Ratio

If the PPE value falls but sales stay the same, the asset turnover ratio will go up. I calculate this as net sales divided by average total assets. Let’s use an example with $8,000 in net sales:

- Before decrease: Asset Turnover = $8,000 / $2,000 = 4.00

- After $100 PPE decrease: Asset Turnover = $8,000 / $1,900 ≈ 4.21

This increase suggests the company is making more money for each dollar of its assets. I always recommend caution here. The change might just be from selling off equipment. It does not always mean the business is running better.

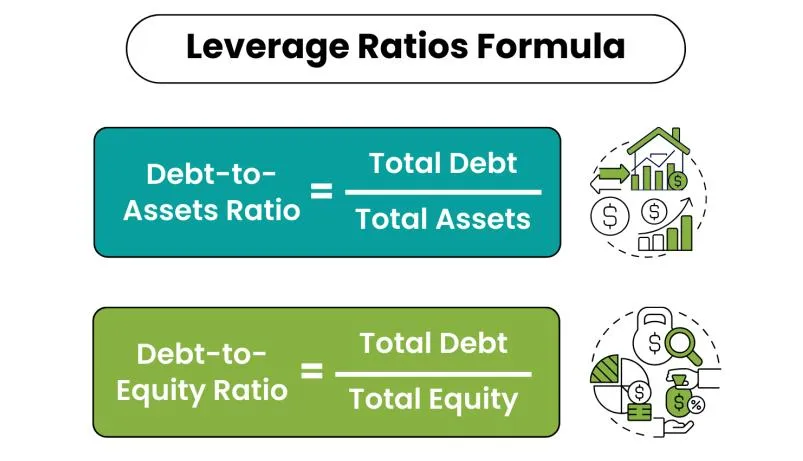

Return on Assets (ROA)

A decrease in total assets will cause the Return on Assets (ROA) to go up, as long as net income stays the same. Using a net income of $800:

- Before: ROA = $800 / $2,000 = 40%

- After: ROA = $800 / $1,900 ≈ 42.1%

I think a higher ROA seems good at first glance. It could, however, reflect asset sales. It might not point to real profit growth.

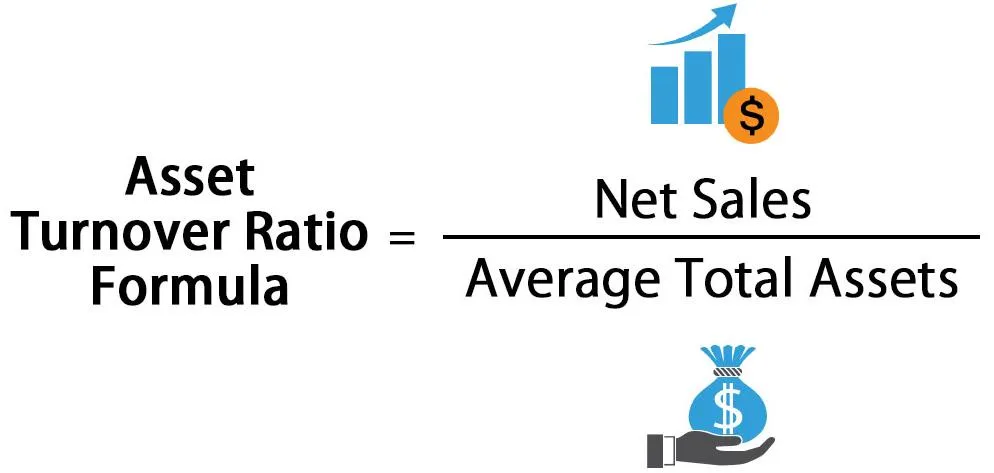

Leverage Ratios

In my analysis, I see leverage ratios like Debt-to-Assets go up when total assets fall. This happens if the company writes down PPE, but its debt level does not change. When you have fewer assets but the same amount of debt, it means:

- The Debt-to-Assets ratio goes up.

- Lenders and investors will see the company as a higher financial risk.

My View on the Financial Analysis

- I notice that efficiency numbers like PPE Turnover get better. This could be from selling assets, not from the business improving its operations.

- Higher leverage ratios suggest more risk. I see this as a bigger problem when there are fewer assets to back up the debt.

- A drop in PPE with the same sales can look efficient. I suggest you also consider if the company is underinvesting or relying too much on outsourcing.

Key Things I Recommend for Analysts and Decision-Makers

- I recommend you first find out why PPE went down. Was it because the business improved, or did it just sell things?

- When efficiency ratios go up, you need to look at the bigger picture. I suggest looking for long-term changes, not single events.

- I’ve seen rising leverage affect how management is judged. It can also raise borrowing costs and change how investors see the company.

- My advice is to interpret these ratio changes with care. This is vital for making smart investment and credit choices.

Examples at a Glance

- $100 decrease in PPE:

- PPE Turnover = $8,000 / $1,900 ≈ $4.21

- ROA rises to ≈ 42.1%

- Debt-to-Assets increases if debt is unchanged

- I believe the benefits are only on the surface if selling assets is what makes the efficiency numbers look good, not real business gains.

My final thought: A drop in PPE can make a company’s numbers look better. From my experience, you must always dig deeper to understand the real reason for the change. This is the only way to get a true picture of the company’s financial health.

Regulatory and Reporting Requirements for PPE Decreases: GAAP vs IFRS

If your company’s Property, Plant, and Personal Protective Equipment loses $100 in value, your reporting method depends on whether you use GAAP or IFRS. From my experience, each of these accounting standards has unique rules. They cover how to test for a loss in value, record it, and report it on financial statements.

GAAP: Impairment Rules and Disclosure for PPE

- Impairment Testing Process: With GAAP, if I see signs of a value drop, I use a two-step test:

- First, I compare the asset’s book value to the future cash I expect it to generate, without any discounting.

- If the book value is higher, I then calculate the loss. I find the difference between the book value and the asset’s current fair value.

- Disclosures in Financial Statements:

- I always disclose the method I used to find the fair value.

- I report any recorded value losses and clearly explain what caused them.

- I also document any adjustments to depreciation methods or rates.

IFRS: Impairment and Disclosure Framework

- Impairment Recognition: Under IFRS, I suggest you test for a drop in value if you see specific warning signs.

- You compare the asset’s book value to its recoverable amount. The recoverable amount is the higher of two things: its fair value less selling costs, or its value in use.

- If the book value is greater than the recoverable amount, you should book a loss.

- Financial Reporting Requirements:

- I recommend you provide detailed notes on how you calculated the fair value and the recoverable amount.

- You should list the specific reasons for the impairment.

- IFRS allows you to reverse a past impairment loss if an asset’s value recovers. I always make sure to disclose any of these reversals.

Financial Statement Disclosures for PPE Decreases

Based on my professional work, both GAAP and IFRS have similar core requirements:

– You must clearly show any impairment losses and the events that led to them.

– You need to report any updates to your depreciation or amortization methods.

– I suggest reporting major PPE sales or new asset purchases on their own.

– You should offer a clear breakdown of how these events impact the company’s financial health.

Audit, Compliance, and Internal Controls

- Auditor’s Obligation: Auditors check to make sure all PPE decreases and value losses are measured correctly. They verify that we disclose them according to the proper standard, either GAAP or IFRS.

- Compliance Requirements: We must follow all the reporting rules. I know from experience that mistakes can result in fines or negative findings in an audit.

- Internal Controls: I believe setting up strong internal checks is essential. These controls help us record, review, and report PPE changes and losses correctly and on time. This process prevents reporting mistakes and helps us pass our regulatory audits.