Every importer wants shipments to move smoothly through customs, but the process can be tricky. One of the most common questions is about product classification. The isolation gown HS Code is the key number you must get right. In this article, you’ll learn how HS codes are structured, which code applies to isolation gowns, and tips to prevent costly errors in your supply chain.

Understanding the HS Code System and What It Means for Isolation Gowns

The Harmonized System (HS) code is a standard way to classify products for international trade. I find it’s like a universal language for customs offices. The World Customs Organization (WCO) manages this system. Over 200 countries use these codes, which cover more than 98% of world trade. They rely on them for setting customs fees, collecting trade data, and applying rules.

How does the HS Code System work?

I suggest you learn how the code is structured. Each HS code starts with a 6-digit base:

- First two digits: chapter (the main product category)

- Next two: heading (the commodity group)

- Last two: subheading (the specific product)

- Countries can add extra digits for their own needs. I’ve often seen up to 10 digits used in the U.S. and EU.

Why Importers Need the Right Isolation Gown HS Code?

It helps you follow international trade rules.

You can be sure you’re paying the right amount for duties and taxes.

It determines if you qualify for special tariff rates or exemptions. This is very important for medical PPE under trade agreements.

It also gives a clear picture for tracking global trade data.

I suggest focusing on it because it improves your supply chain operations and lowers your risk at customs.

Common Isolation Gown HS Codes: What Importers Need to Know

From my experience, choosing the right isolation gown HS code is critical. It helps you get through customs easily, pay the correct duties, and follow trade laws. Let me walk you through the most common isolation gown HS codes. I’ll explain how people use them with real-world examples.

Main Isolation Gown HS Codes and Their Applications

| HS Code | Description | Typical Uses / Notes |

|---|---|---|

| 6210.10 | Gowns made from certain textile fabrics (e.g., felt under heading 56.02 or textiles with plastics under heading 59.03) | Used for materials like felt or textiles with plastics |

| 6210.10.5000 | Disposable, nonwoven apparel | Items for hospitals, labs, clinics, or any contaminated area |

| 6307.90.99 | Miscellaneous textile articles, not elsewhere specified (often disposable gowns) | Common in the US for disposable gowns in humanitarian aid/emergencies; covers many disposable items not for retail sale |

| 6210.10.1000 | Disposable non-sterile isolation gowns (two-layer polypropylene/polyethylene) | Go-to code for non-sterile disposable gowns; common during COVID-19 for testing and infection control |

| 6210.10.92 | Single-use surgical gowns made from nonwoven fabric (sizes S to XXL, weight 90g–130g) | Often used by European countries |

Isolation Gown HS Code Examples

HS Code 6210.10.1000:

Here’s a product I’ve seen use this code: Disposable gowns from South Korea. They were two-layered (polypropylene/polyethylene) and came in sizes L and XL. The packaging was 10 gowns per pack, with 10 packs in a carton. The carton’s gross weight changed with the gown size. A single 40-foot pallet could hold up to 17,600 gowns.

HS Code 6210.10.92:

Here’s another example. This code fits nonwoven, single-use surgical gowns. They work for both patients and surgeons. You will find them in sizes S–XXL, with weights from 90g to 130g.

Global Differences and Usage Statistics of Isolation Gown HS Code

In the United States, I observe that HS Code 6307.90.99 is the most common choice for disposable isolation gowns. It applies to both commercial sales and humanitarian shipments.

Europe and many Asian countries prefer the 6210.10 series. These codes offer more detail for surgical or non-sterile medical gowns.

Recent data shows something interesting. In the US, over 7.2 million import/export deals have used HS Code 6307.90.99 for these gowns since the pandemic started. This number shows the huge global demand. From my perspective, it proves why using the correct HS code is so vital for these products.

Disposable Isolation Gowns HS Codes: My Guide to Features & Classification

From my experience, picking the right disposable isolation gowns HS code is very important. This helps you get through customs without any trouble. The most common code I see is 6210.10.5000. This code covers nonwoven disposable clothing for hospitals, clinics, and labs.

Key Features for Gowns Under HS 6210.10.5000

Material:

These gowns are made from nonwoven polypropylene, SMS (spunbond-meltblown-spunbond), or polyethylene-coated fabrics. I find these materials offer the best standard for infection control and surgical use.

Typical Products:

This includes items like isolation gowns, hospital gowns, and lab coats. All of them must be nonwoven and for single-use only.

Usage Scenarios:

I recommend this code for products used in medical settings like infection control, surgeries, and lab work. You’ll see product lines like 77-9058 and 77-9060 in many hospitals.

Duty Rate (U.S.):

2.5% ad valorem for imports.

Other Isolation Gown HS Codes and Product Differences

Non-medical coveralls:

I suggest using HS 6210.10.9010 for coveralls that look like isolation gowns but are not for hospital use.

Additional codes:

In U.S. customs, you might see code 98049000. It helps track medical garments, but I must stress that 6210.10.5000 is still the main classification you should use.

Keywords:

Customs officials check for words like “nonwoven,” “disposable,” and “protective apparel.” I recommend including these in your product descriptions to confirm the classification.

How I Describe Products by Code

- “Nonwoven disposable isolation gown, SMS fabric, elastic cuffs, single-use, hospital—HS 6210.10.5000”

- “Polyethylene-coated, impregnated nonwoven hospital gown for infection control—HS 6210.10”

In my opinion, using these specific isolation gown HS codes and product details is the best approach. It helps prevent import delays and keeps you in line with regulations.

Key Criteria for Assigning Isolation Gown HS Codes

From my experience, getting the right isolation gown HS code is crucial. You need to consider a few key factors. These factors affect customs clearance and how much you pay in tariffs.

Main Classification Criteria of Isolation Gown HS Code

Material Composition:

Most isolation gowns use a non-woven polyspun bond fabric. If your gown is made from this material, I’d suggest you look at the codes for nonwoven disposable clothing. The correct heading is “Garments, made up of fabrics of heading 5602 or 5603.”

Intended Use:

In my view, you must know how the gown will be used. Customs classifies gowns for medical or hospital use with a different code than gowns for personal use. For example, the US uses HTS 6210.10.5000 for nonwoven gowns used in hospitals or labs. This code usually has a 2.5% duty rate.

Essential Product Details Required

Based on my experience, customs needs specific product details to assign the right HS code. They will check for:

– Fabric type: Nonwoven, woven, knitted, or crocheted

– Design features: Length, sleeves, elastic cuffs, type of closures or reinforcements, weatherproofing

– Intended market: Medical, personal, donation, or sale

– Consistent packaging: All items must match in fabric, size, style, and color

Relevant Isolation Gown HS Codes and Real Examples

- 6210.10.5000:

This covers hospital and isolation gowns made of nonwoven fabric for medical use.

An example is our Style 77-9060. It’s a non-woven polyspun bond gown, is knee-length, and has elastic cuffs. - 98049000:

This is a US code. It applies to Level 1 and Level 2 isolation gowns that you import for donation, not for selling. - 6114.90.90:

I recommend this code for imported knitted or crocheted garments that don’t qualify for hospital use.

Making a mistake with the isolation gown HS code can cause big problems. You might face customs delays, pay the wrong duties, or lose out on trade benefits. I strongly suggest you match the gown’s features and its intended use to the correct HS code.

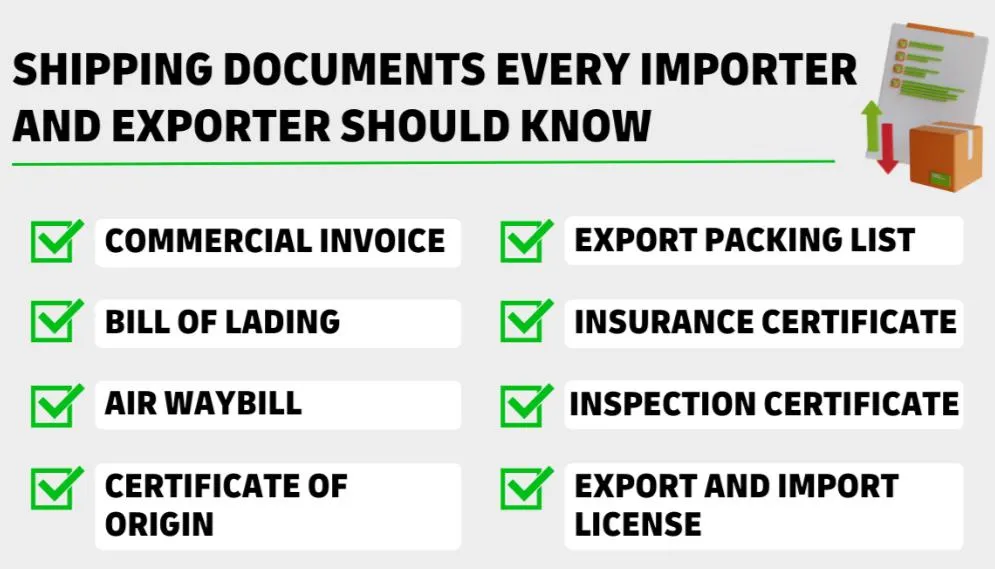

Getting Your Paperwork Right for Importing Isolation Gowns

To get your isolation gowns through customs smoothly and follow the law, you need the right paperwork. Based on my experience, here are the essential documents I recommend you prepare:

What Your Paperwork Must Include?

Product ID:

I suggest you list the isolation gown manufacturer‘s name, the product’s name, and a clear description. You also need to state if it is a surgical gown or another type, like a coverall.

Codes & Contacts:

You will need to list the correct product classification number and a detailed product description. I also recommend you provide your U.S. contact’s information.

Proof of Standards:

You should submit test reports. These show the gown meets ANSI/AAMI PB70 protection levels (Levels 1–4). I find it helps to include sketches or photos to show the protection zones, sewing style, and safety features.

FDA and Customs Info:

Assign the correct HTS code and flag it as FD1 for FDA review.

For EUA products, send entry data to the FDA with Intended Use Code 940.000 and the FDA product code.

For the Enforcement Discretion Policy, use Intended Use Code 081.006.

If importing to Canada, include authorization code 73-2529 and add “URGENT – COVID-19” to the release notes.

My Tips for a Smooth Import Process

- I recommend keeping a complete file for every shipment. This file should have photos, product specs, the ANSI/AAMI PB70 level statement, and all compliance documents.

- Label your products well. If an item is “not for medical use,” be sure the label says so.

- Keep an eye on updates from the FDA, Health Canada, or customs. This helps you avoid new compliance problems down the road.

- For any PPE not meant for medical use, you must use the correct industrial codes and make no claims about medical protection.

From my experience, using these practices and preparing all the right documents helps importers prevent expensive customs delays and legal problems.

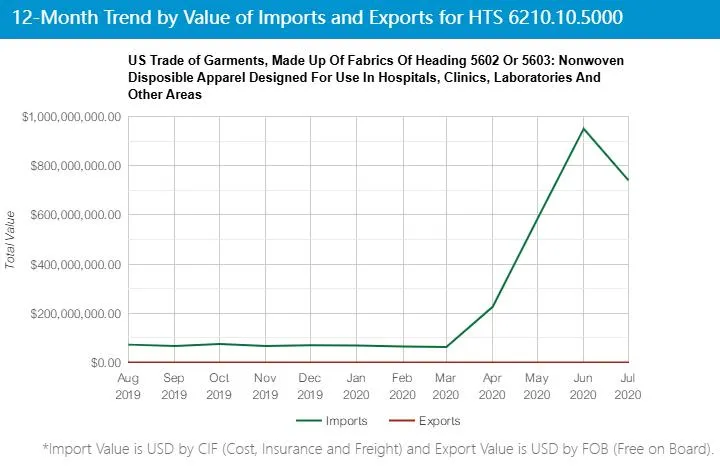

Isolation Gown HS Code Import/Export Data: Core Facts and Trends

From my experience, understanding the latest data on isolation gown HS codes gives you an edge as an importer. I suggest you focus on these key points when sourcing gowns from other countries.

Essential Isolation Gown HS Codes & Product Categories

I recommend you use these primary U.S. codes for disposable gowns: 6210.10.5000 and 6210.10.5010.

You should also know the codes for reusable gowns: 3926.20.9050 , 6113.00.1012 , 6210.10.2000 , 6210.10.9040 , 6210.50.5555 , 6211.42.1081 , and 6211.43.1091 .

I’ve found that most U.S. imports are disposable gowns. Reusable isolation gowns are often included in broader, more general import categories.

Trade Volumes, Prices, and Trends

China is the main supplier of disposable isolation gowns to the United States. I believe this happens because of their lower manufacturing costs.

At the pandemic’s peak (June–August 2020), U.S. imports climbed to about 1,000 million units per month.

By January 2021, the import volume per month had fallen. It dropped below 400 million units.

I saw import prices go down as the market filled with supply and demand went back to normal. A typical large shipment in March 2021 was valued at $0.50 per gown.

Market Dynamics and Reporting

Government orders and official buying cause sudden increases in demand. When federal purchasing slowed, I noticed order sizes got smaller and prices became more competitive.

I see typical shipments contain hundreds of thousands to millions of units. You can track these with trade platforms. The platforms report the HS code, shipment dates, quantities, ports, and importer/exporter details.

In my opinion, isolation gown HS codes are critical. You need them to meet customs rules, set tariff rates, and ensure all your gown shipments follow regulations.

Isolation Gown HS Codes: Common Mistakes and My Tips

Getting the wrong isolation gown HS codes can cost you a lot of money. Based on my experience, here is what you need to look out for to avoid these expensive errors.

Isolation Gown HS Codes’ Common Mistakes and What Happens Next

I find that these are the most common errors importers make:

Using old HS/HTS codes:

The codes were updated in January 2022. Many importers are still using the old ones. This is a big problem.

Mixing up product types:

It’s easy to confuse isolation gowns with surgical gowns, headwear, or shoe covers. I suggest you pay close attention to the product details.

Thinking your agent is responsible:

This is a major misconception. Customs holds you, the importer, responsible, not your agent.

Not checking with customs:

People often use unofficial sources or just don’t double-check. This leads to incorrect codes.

The consequences can be severe:

- Customs authorities can issue large fines and legal penalties.

- They can reject, seize, or hold your shipments. This causes delays for inspections and refund reviews.

- You might have to pay extra duty and not get a refund. You could also face penalties and interest if you underpaid.

- If you make the same mistake over and over, you could lose your import and export rights.

A Canadian review found 20% of shipments had wrong codes. This mistake caused $21 million in lost government revenue. It also led to $136 million in refund claims from isolation gown importers who overpaid.

My Recommendations for Correct Isolation Gown HS Codes

I recommend you confirm the codes with government customs authorities before every shipment.

Make sure you use the latest official customs code databases.

You should assign a code after you review all product details and know how the gown will be used.

I also suggest you check for updates from the World Customs Organization and your destination country’s customs office.

If you ship to the US, the HTS codes have 10 digits. The first six are standard HS digits, and the last four are specific to the US. Canada also has its own 10-digit code system.

My Practical Tips to Stay Compliant

- I suggest creating a checklist for every shipment. Use it to track your isolation gown HS code verification.

- Train your team and your agents on how to classify isolation gown HS codes correctly. This helps stop errors before they happen.

- You can use good digital logistics platforms. They help manage HS codes and track your compliance.

- I think it’s wise to write down every step you take to choose and check your HS code. This documentation can protect you if there are any disagreements later.

In my opinion, using these tips will lower your financial risk. It will also help you avoid delays and penalties. You can be confident you are compliant when importing isolation gowns.